For most people, investment is a topic that they tend to view as being complicated and intimidating. Financial experts proclaim that a lack of understanding and the proliferation of misleading information, keep people away from investing, especially when it comes to investing in the stock market. But, in today's world more and more companies have been lowering the barrier to investing by providing straightforward solutions and a multitude of resources that people can use to improve their knowledge about different investment opportunities. One of the companies leading the way in this regard is called Acorns. Acorns can be best described as being a robo-advisor that operates on the time-tested idea of saving spare change. In fact, the developers of the company proclaimed that its name comes from the old proverb which states that "large oaks start from small acorns".

Developer: Acorns

1. Go to Settings menu;

2. Choose Apps or Application manager;

3. Touch the app you want to remove;

4. Press Uninstall.

Features and Benefits

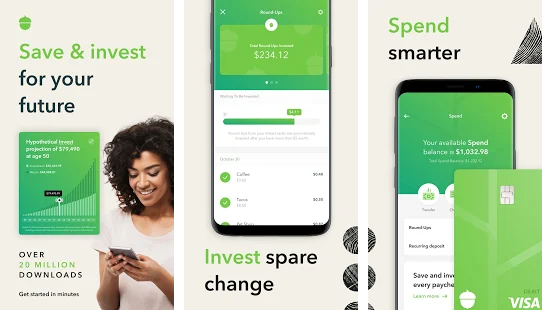

Available to Android and iOS users, it's a multifunctional personal finance app that provides users an automated micro savings account, checking account, cashback-tool and investment portfolios. Upon downloading the app users are able to utilize over 5 different products which are:

- Acorns Later

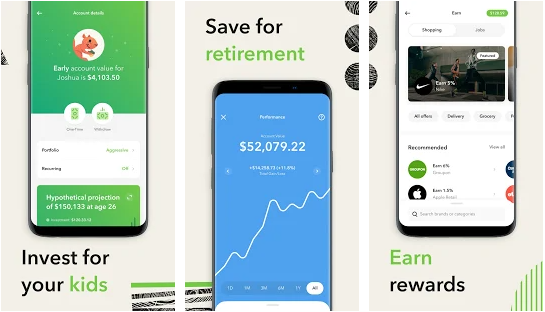

- Acorns Early

- Acorns Spend

- Acorns Invest

- Acorns Earn

The selections that a user is able to choose from is based on the plan they subscribed to. The aforementioned selections can operate on their own, or they can work in conjunction with one another. For example, individuals who sign up for the "Lite" plan are only able to use Acorns Invest. This is an investment account, which can be set to automatically save spare change from your purchases. Acorns Later functions similarly to the investment feature, but gives you the ability to invest towards your retirement in an Individual Retirement Account. Acorns Spend is the name that they use for their FDIC insured checking account, which comes with a metal debit card. The Acorns Earn product consist of a wide array of cash-back and saving related tools, that helps users to save money, and earn cashback from everyday purchases. Additionally, Acorns Earn users, who also have an Acorns Spend account can link their debit card, so that they can take advantage of exclusive cashback deals and special pricing from over 300 of the top brands in the country such as Airbnb, Apple, Walmart and Nike. Users who elect to use Acorns Earn also get access to a job search tool.

The checking account that Acorns provides has additional features that you wouldn't find in a typical checking account. With an Acorns checking account, users are able to establish recurring deposits to the Later or Invest section of the app. Additionally, users can round up their purchases so that spare change goes toward their investment portfolio. For example, users can stipulate that the app should allocate $1 to their investment account, each time they make a purchase from their checking account. One of the more profound features of Acorns is their Smart Deposit feature. By using the Smart Deposit feature, users can split their direct deposits between their investments, savings and checking account. For instance, if a user gets $3000 in direct deposit payments per month, with Acorns Smart Deposit, said user can allocate 50% of the direct deposit to go directly into their checking account, 25% in their savings and 25% in their investment portfolio.

When it comes to pricing, its three tier plan is fairly straightforward: Lite, Personal and Family. The first of which cost only $1 per month. Meanwhile the Personal plan costs $3 and the Family plans cost $5. With the basic plan, users get an Acorns Invest account, which is essentially an investment account which has a roundup feature. With the Personal plan, users gain access to Acorns Spend and Acorns Later which are checking and retirement accounts. The family plan gives users access to Uniform Gifts to Minors Act(UGMA) accounts for children. UGMAs are fairly common in multiple states across the country. Unlike a 529 Plan, the fund within an UGMA account is not restricted to college tuition only. With an UGMA account, the child can use the funds for almost anything that benefits them. It's also worth noting that unlike a 529 Plan, parents themselves also have access to the funds, provided that they spend it on something that benefits the child.

Pros

- Low Minimum Deposit - Many financial experts have praised Acorns for lowering the financial barrier of investing by giving users the opportunity to invest with as little as $5. Additionally, users can also round up leftover pennies from their purchases.

- Easy To Use - The app's interface is very user friendly. Users can set up their accounts in just a few minutes as to which they can immediately start making investments. Additionally, users need not worry about trading or picking stocks. The money they invest is automatically placed in a portfolio of Exchange Traded Funds based on investment sectors that the user is interested in such as the technology or medical business sector.

Cons

- Low Investment Strategy - The concept of investing spare change from the purchases you make, may sound effective and straightforward, but you have to compare said concept to your financial goals. For example, if you customize the app to make a roundup of $.30 for each transaction you make and end up making 60 transactions by the end of the month, the app will have only invested $19.

- High Annual Fee For Low Balances - Based on the fact the app charges a flat management fee of only $1 per month, it can actually cost you a significant percentage of your assets if you don't have an abundance of money in the account. For example, if you only have $500 in your account, a $1 monthly fee would equate to 0.20% of your asset. Multiply that by twelve months and you're looking at an annual fee of 2.40% of the $500 balance. When you look at what other robo-advisors charge, it's a substantially high rate. Most robo-advisors charge an annual rate of only .50% or less annually.

Is Acorns Ideal For You?

If you want to put your spare change to good use and get an occasional cashback from some of the most popular retailers in the country, Acorns may be an ideal solution to help you do that. It's automatic roundup feature makes investing and saving easy. Over time, you'll be surprised at how fast those pennies accumulate. But, if you maintain a small balance on the account, it's fees can negate a large portion of your investment returns.